Excise duty collection is effective, though administration costs are growing

PRESS RELEASE on Audit No. 15/33 – 7. 11. 2016

The Supreme Audit Office (SAO) investigated the effectiveness of excise duty collection and proceedings of customs offices within the period 2012–2015. Excise duties include taxes on mineral oils, spirits, tobacco and energy. Auditors focused on the operation of the Customs Administration of the Czech Republic (CA), scrutinized the administration costs related to excise duties, and also analysed the effectiveness of projects worth CZK 68 million in total, which aimed at savings and improvements of the CA’s operation.

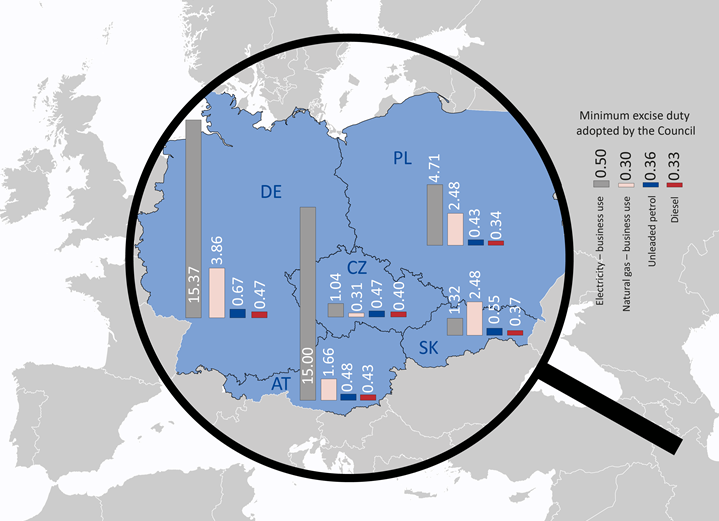

In 2015, CZK 148,000 million was collected in excise duties, which is over CZK 10,000 million more than in 2010. When compared to members of the Organisation for Economic Cooperation and Development (OECD), the Czech Republic reported above average excise duty incomes. Within the audited period, the share of excise duties in the country's tax revenues declined, dropping to the lowest figure since 2005 in 2014. For example, the energy tax rates are rather low in the Czech Republic in comparison to neighbouring EU countries (see the attached graphics).

Rates of exercise duties by January 1, 2016, in selected EU countries – diesel and petrol (EUR per 1 litre), natural gas (EUR per 1 gigajoule), electricity (EUR per 1 megawatt hour)

Source: European Commission – Excise duty tables – part II – Energy products and Electricity.

The Czech Republic is one of the best countries in terms of excise duty collection. Auditors applied various methods to analyse the administration load related to each CZK 100 collected as excise duty and concluded that collection costs reached CZK 0.73 per CZK 100 of revenues. Still, duty collection costs were growing from 2013 to 2015.

The administration costs have added over the past few years due to the growing number of responsibilities and those who are involved in paying taxes. For example, costs of preliminary analysis before issuing permits multiplied by six because of new regulations effective since 2015. The General Directorate of Customs implemented several IT products in order to gather data necessary for excise duty administration, including interactive electronic tax forms and an evidence of trade marks. However, the gathered electronic data are not sufficiently processed.

The audit report concluded that if civil employees, instead of customs officers, carried out the administrative tasks, like for instance at the Financial Administration bodies, it would bring CZK 83 million a year in savings. As a security institution’s employees, the customs officers are supposed to perform tasks related to ensuring security.

Auditors focused on two projects worth CZK 68 million in total, which were supposed to improve the Customs Administration's operation and save money. Though, the Customs Administration did not manage to lower its administration load. One modernisation project that cost CZK 51 million was supposed to bring savings and increase the effectiveness of the CA by changing its organisational structure from three- to two-tiered one. However, the objectives were met only partially and the implemented changes could have been done without the Project. Staffing needs were expected to drop down by 403 employees within the period 2012–2015, but the number of systemic job positions only decreased by 13 employees while the operation costs increased by CZK 460 million. A project worth CZK 17 million aimed at implementation of a strategic management at the CA. However, three years after the Project’s completion, the Customs Administration has not managed to lower its administration costs.

The SAO also scrutinized the supervision of transport and production of the taxed goods and concluded that the processes followed the EU policies and exceeded significantly the minimum requirements given by the EU legislation.

Communication Department

Supreme Audit Office