With the cancellation of the electronic sales registration, tax administrators have lost one of the tools for targeted investigation of tax evasion

PRESS RELEASE ON AUDIT NO 23/09 – 15 July 2024

In the fight against tax evasion, two new tools were introduced in the Czech Republic in 2016 - the VAT Control Statement from January and the electronic sales registration (ESR) from December. Over the course of six years, the Czech Financial Administration (CFA) detected over 10 million risky transactions through the VAT Control Statement and collected almost CZK 11 billion in value added tax (VAT). Thanks to the ESR, an additional CZK 652 million was levied in income taxes and VAT from 2017 to 2019. With the subsequent cancellation of the ESR in January 2023, tax administrators lost one of the important tools for targeted tax evasion investigations and, in the case of VAT, for detecting taxpayers who failed to register for VAT even though they exceeded the legal limit for mandatory registration. The Supreme Audit Office (SAO) stated this after completing an audit focused on selected measures against VAT evasion.

The SAO evaluated the funds spent by the General Financial Directorate (GFD) on VAT Control Statements in 2015-2022 in the amount of CZK 257.6 million as effective. By analysing the data from the VAT Control Statements, the CFA detected more than 10 million risky transactions and levied VAT for the years 2016-2022 in the amount of CZK 10.8 billion, which is 16% of the total tax levied in these years. Among the most frequent findings of the CFA were, for example, unjustified VAT deductions from fictitious invoices or the fact that entrepreneurs did not prove to the tax administration that they actually used the purchases of services, goods or materials from the received invoices for their economic activity.

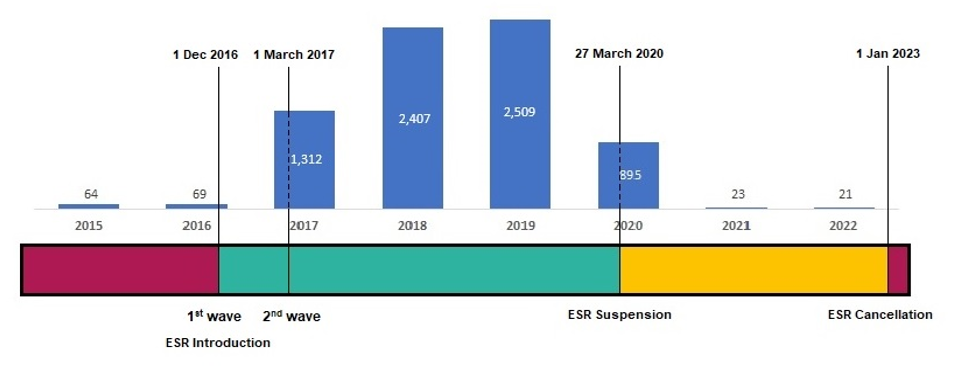

The SAO found that based on data from the ESR, the CFA levied a total of CZK 652 million in income taxes and VAT in 2017-2019, of which CZK 184.9 million in VAT revenue. From a VAT perspective, the ESR was also a means to a more efficient and administratively simple detection of tax subjects who exceeded the threshold for mandatory VAT registration but did not register for VAT. For example, a person who exceeded a turnover of CZK 1,000,000 in no more than twelve consecutive calendar months became a VAT payer in the audited period. During the audit, the SAO found out that the CFA, using data from the ESR, registered a total of 7,167 tax subjects for VAT in the years 2017-2022 due to exceeding the legal limit. Thus, between 2017 and 2019, an average of 2,076 entities were newly registered for VAT each year due to exceeding the legal limit. Until then, the annual number of registrations was below 70. After the suspension of the ESR, the number of new VAT registrations even dropped to around 20 per year in 2021 and 2022 (see the graph below).

Compliance with the obligations arising from the ESR Act was checked by the CFA and the Customs Administration of the Czech Republic in the form of inspection purchases. They carried out a total of 258,656 inspections and in almost a third of them they found violations of the ESR Act. Of the sanctions imposed in the amount of CZK 229.7 million, almost 96 per cent were paid (i.e. CZK 220 million).

The Ministry of Finance, the GFD and the General Directorate of Customs spent a total of CZK 2.24 billion on the introduction and operation of the ESR in 2015-2023. The introduction of the first and second waves of the ESR was to affect 19% of tax entities that were obliged to record their sales. This assumption was met in the first two years and the increase in the number of entities registered for ESR continued until 2019. Of the total number of tax entities registered for ESR, more than 50% were VAT payers.

The obligation to record sales was to be introduced in four waves. In the first wave, sales for catering and accommodation services were recorded (December 2016), the second wave included wholesale and retail trade (March 2017). The obligation to record sales under the ESR Act for entities included in the other two waves was postponed as a result of the Constitutional Court's decision, and also in light of the COVID-19 pandemic. ESR has been suspended from 27 March 2020 to 31 December 2022 and cancelled from 1 January 2023.

Number of newly registered entities for VAT due to exceeding the limit

Communication Department

Supreme Audit Office